Is the “invisible hand” controlling the commercial real estate market?

In the 1770’s the famed philosopher and economist Adam Smith (Wealth of Nations) sought to explain what we now refer to as capitalism by invoking the phrase “invisible hand”. Smith used this metaphor to express the idea that in a free and open society, economic progress was achieved by an unknown market force brought about by mutual interdependence. Its classical economics, each person or business aiming to build a better service or product resulting in overall economic growth.

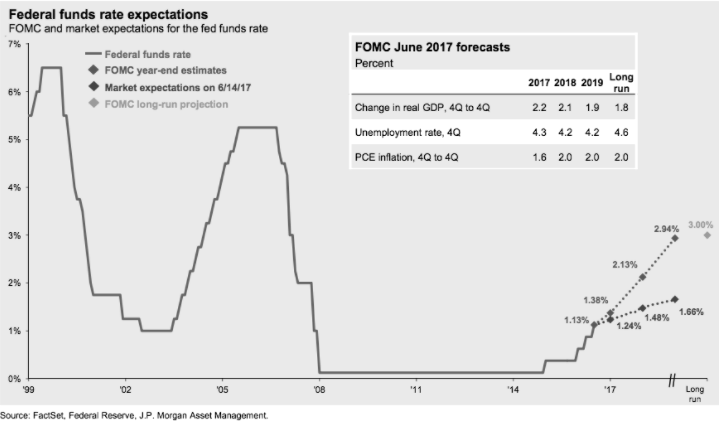

Leap forward to the 21st century and we observe that there are other forces at work in the modern economy, namely interest rates. The figurative hand is not invisible and in fact we know that it’s the hand of a woman, her name is Janet Yellen. In December 2015 the Federal Reserve, lead by Yellen, effectively raised short term interest rates by 25 basis points or ¼ percent (see chart below). This reversed a seven year status quo of zero percent rates that was initially put into place as a response to the 2008/2009 financial crisis. When interest rate policy changes or there is mere discussion of changing rates, markets tend to react (sharply at times) to the new environment.

Commercial real estate is not immune to volatile market responses, however just like many other assets, interest rates aren’t the sole influence on pricing. Rising interest rates can be a sign of a strong economy. Consider this, if interest rates fall when the economy is in peril than the opposite might be true. The Federal Reserve monitors many aspects of the US economy as they evaluate interest rate policy, but employment and inflation are the dominant factors. If the employment and inflation rate are within a range that the Fed believes reflects a healthy economy, they will raise rates or lessen their monetary support by other means. “Cheap money” is a phrase we sometimes hear when discussing interest rates. It suggests that low interest rates flood the economy with excess cash. This is true and is one of the Fed’s objectives. However the person typically using this phrase believes that “cheap money” artificially props asset prices up which then result in a bubble.

“Cheap money” doesn’t GUARANTEE a bubble

Once again this theory hinges on the idea that interest rates are the main decision to invest in an asset. Money wasn’t cheap in 2005-2006 as the residential real estate bubble was inflating. One of the reasons the Fed wants to flood the financial system with cash is that it’s attempting to reverse a deflationary spiral in asset prices. It’s true that low interest rates make a commercial real estate transaction (and many others) more attractive regarding borrowing costs but one hopes there are other factors supporting the transaction. The recent changes in US interest rate policy should make investors and other stakeholders re-examine the financials of any pending or future transaction. The judgement of a commercial real estate transaction or any investment for that matter should be gauged against a balance of factors. The question remains, can the Fed can manage this massive shift in US interest rate policy in a manner that doesn’t disrupt the positive momentum in the economy.

National Market

Prices have traded sideways for much of 2017. RCA (Real Capital Analytics) reports in their latest summary that prices lifted 2.2% in May. This was after a mixed start through the first four months of the year. The May reading is the strongest in eight months, possibly indicating a new positive trend is emerging.

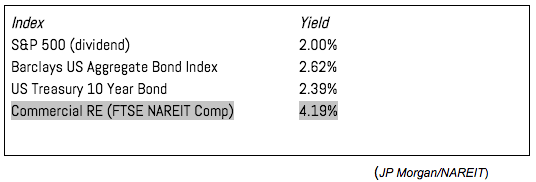

The current strength of the US CRE market is supported by the slowly improving fundamental economic backdrop in the US along with steady foreign capital flows. According to the Association of Foreign Investors in Real Estate (AFIRE), investors outside of the US expect to increase their investment in 2017. The International Monetary Fund’s (IMF) view reinforces this sentiment by forecasting that global growth will contribute to increased flows to US commercial real estate (NAR). Another aspect to the foreign investment dynamic is one about relative returns.

Commercial RE compared to other asset classes

The current outlook in the US commercial real estate market isn’t universally positive. Steve Matthews of Bloomberg reports that in a January 2017 speech, Fed Chair Yellen expressed concerns by characterizing the market as “high” noting that they are monitoring the market for hyper speculation. Eric Rosengren of the Federal Reserve Bank of Boston shared that opinion by stating “If you look at prices of commercial real estate, particularly multifamily properties, they have been going up very rapidly in many parts of the country.” Without a doubt, the major markets in the US multifamily development have experienced a tremendous bump in supply. This supply came after the marketplace showed a dramatic shift towards renting versus homeownership. After the financial crisis banks tightened lending standards while at the same time there was a major shift in consumer bias toward renting (Bloomberg).

Regional Market

It's an understatement to say that the Pittsburgh commercial real estate market has went through a positive transformation over the last decade. These changes can be seen visually throughout the region but are also exhibited in market analysis. The vacancy rate for the region is a powerful example of the change. From 2005-2016 vacancy rates went from 15.6% to a low set in Q3 2016 of 7.5% (CoStar). The vacancy rate remains low while also tracking below the national average. The energy sector has provided support to the local marketplace as companies such as Chevron and Rice Energy have signed meaningful leases in the last few years.

Employment + Emerging industry = HEALTHY MARKET

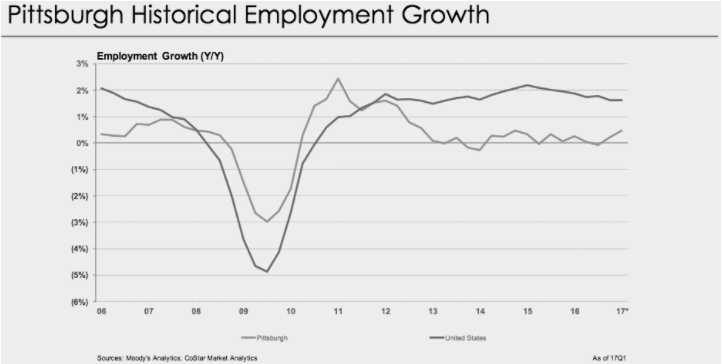

Employment stability in the Pittsburgh metro area has long been bolstered by the education and healthcare sectors. Those two industries tend to be less sensitive to broad cyclical changes in the economy. Having a stable foundation for employment helps maintain property prices in the region. Since 2007 Pittsburgh’s employment trajectory mirrors that of the United States. However, as shown in the illustration below, the volatility in the Pittsburgh job market is less dramatic. A less reactive job market can be an important factor in stabilizing overall economic activity in the region.

Beyond providing a stable economic engine in the Pittsburgh region, its top universities are fostering entrepreneurship and startup creation in emerging industries. Whether its robotics, AI, and advanced manufacturing, schools are partnering and supplying talent to companies that invest and grow in Pittsburgh. The US government isn’t blind to the opportunity in the region. In 2015 Pittsburgh was chosen to be apart of Investing in Manufacturing Communities Partnership program. The initiative will invest $1.3 billion throughout the country to build public-private partnerships to support regional manufacturing (CoStar). The combination of an exceptional talent pool, low cost of living, and an innovative spirit make Pittsburgh an inspiring place to invest.